|

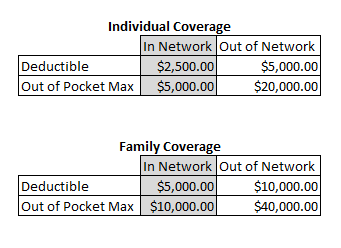

Formulary, Preferred, Generic, Name Brand, Off Label, Pre-approval, Copay, HDHP, PPO, HMO... there are so many possibly unfamiliar terms when it comes to medical insurance. When you are signing up for a medical plan, whether through your employer or the market place, it is imperative that you make yourself an informed consumer. This means taking the time to understand all the ins and outs of the plans available to you and your family. If you are choosing insurance through your employer the Human Resources department can be an invaluable resource for you. They know the ins and outs of your plan(s) and if they don't have an answer to a specific question they can often give you the number of someone who will. It is important to remember that they are still your employer and coworkers so you may not want to share ALL your medical information with them but they can help to explain your plan options in broad strokes so that you can chose the best plan for your family. A few things to look for: What pharmacies and providers are in-network?Never ask a provider if they 'take' or 'accept' your insurance- the answer will likely be yes- you want to know if they are in-network. I'm not completely jaded and understand and even trust that most providers will be up front with me if I mess up and ask if they take my insurance but I was burned once, badly, and learned my lesson so no longer do this. In my case I was lied to by a front office staff member at an Urgent Care center and spent the better part of a year fighting about those out-of-network costs with the provider and my insurance company, it was not fun. If there is a provider that it is important that you see then you should call the insurance company and ask if they are in-network before you sign up for a plan and double check with your insurance company before going to a new provider. Going out of network can mean significantly higher costs not just for your specific medication or visit but for the whole year as you have separate in- and out-of-network deductibles and out-of-pocket maximums. It may look something like this: Are there Preferred pharmacies?This can often save you money as well. You will often see this affecting you when it comes to co-pays and co-insurance so it never hurts to ask. Going across the street could save you 10%! What is my deductible?Is there a per person deductible or per family? Does it include prescription medications or is that a separate deductible? Some plans will have a separate prescription deductible that you will have to meet before medications reduce in price or become paid for. This deductible will typically go towards to you out-of-pocket maximum just like your medical deductible but its important to know if you are going to be juggling multiple deductibles. What is my individual and family out-of-pocket maximum?If you have one high utilizing family member then its important to note that often plans will include a per-person cap that can keep your costs lower... you many not have to get all the way to the family out of pocket max to stop paying for that person's care for the year. This can be a lifesaver when it comes to the budget. What medication are formulary or covered?Check the plan every year, even if your plan has not changed, to make sure that all your current medications are covered. Insurance companies issue a new list of changes each year and you can often find this on the website but if not then simply call in and request it. How does the co-insurance work?Once you hit your deductible you will often still be responsible for some of the costs until you reach a higher number, the out-of-pocket maximum. This is usually calculated at a percentage. So if you have a co-insurance of 80% once you hit your deductible that would mean that you are responsible for paying 20% of the cost for your care until you reach that number. In and Out of Network still apply for this portion of your yearly cost so its important to stay in-network if at all possible. What are the requirements for Specialty medications?For certain medications, typically higher costing medications and ones that require temperature control, some plans will require you to use their Specialty Pharmacy in order to get them filled. This saves them money which in turn saves you money in the long run but it can be a little frustrating to have to schedule delivery for these medications and call in your payment/authorization to ship each month. If you have a medication that falls under this type of requirement they will let you know when you try to fill it at a retail pharmacy but if you think it may apply to your situation it could speed up the process to simply call the insurance company to ask up front what their policy is in regards to that medication. Processing at these pharmacies takes much longer than your corner CVS so planning your doses out is imperative for these kinds of medications. How do Prior Authorizations work on this plan?Certain medications, treatment plans, surgeries or even provider types may require Prior Authorization in order to be covered. These will typically span a length of time and then require renewal if it is an ongoing treatment. This is a pain to go through and number two cause for my personal medical plan headaches but its important to understand and follow this process or you could end up paying the full cost of treatment as the charges will be denied. I am personally on a medication that costs over $2,000 per month for me to take... you can bet it requires Prior Authorization. Every 6-18 months (depending on how long they authorize the treatment plan) my doctor's office has to file paperwork showing that I still need the care. Sometimes its easy but other times its a fight. Sometimes its just not worth that fight and we will chose an alternative treatment or I will pay out-of-pocket, like i did for my current rescue inhaler. Being prepared for this process and not letting it frustrate you if important- the insurance company is trying to keep their costs down by verifying that the treatment is necessary which helps keep costs from rising even more for everyone. What do I need to do in order to see a Specialist?For some types of plans all you have to do is show up to receive covered care but for other you may need a referral. Knowing this up front will save you headaches and money from fees for seeking care without a referral. Is ____ covered?If you are looking for a specific type of care then ask up front if it is available on plan and if so how many sessions/how often you are able to get it. A good example of this is chiropractic care. Some plans offer it but they may limit the number of sessions you are able to have covered per year. Other options could be infertility treatments or in-home care. If its not then you may need to purchase supplemental insurance or go with a different plan. Are there any perks to the program?I am with Blue Cross Blue Shield of Texas currently and there are a ton! My plan includes an identify theft program, a gym membership discount plan, teledoc services, free coupons to all kinds of health related retailers, discounted magazines, a wellness points plan and even discounts on services they don't cover like acupuncture and massage at certain providers through one of their free programs. On the wellness plan I get points for doing things like going to the gym, taking an online class, entering my stats quarterly, and etc. which I can exchange for prizes like kitchen gadgets, gift cards, and more. You can bet I participate in this when I have time... a few minutes while waiting around gets me a little closer to a free blender. :) Does this plan qualify for a FSA or HSA? If so is one offered?Flexible Spending Plans (FSA) and Health Savings Plans (HSA) are two ways that you can pay for medical costs with pre-tax money. They both have their own requirements as well as good/bad points but having access to pre-tax money can save you quite a bit of money. I'll do a separate post on these plans but if your employer offers them please learn about them and utilize them. They may also have a Limited FSA just for Dental and Vision, a Dependent Care FSA to help pay for childcare expenses pre-tax or an Health Reimbursement Program (HRA) that, while it isn't tax free, is free money to help you meet your medical costs if you submit for it. All of these plans are going to be employer specific in whether they are provided and through which providers but making sure to really understand your benefits package is an important part of providing health care for your family and being an advocate for your own.

I hope this helps you navigate your medical insurance journey. Until next time, |

Details

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed