|

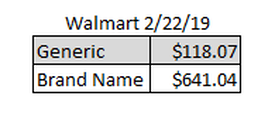

Medical costs are on the rise and, if you're anything like me, can add up in no time at all. I know that I'm not the average patient when it comes to my annual medical spend (I hit the max every year... thank you chronic illness) but even low utilizers can find themselves paying more than they should for medical care. I wanted to take a few minutes today to pass along a few ways to make sure you are getting the best deal on your medications- the bulk of most people's annual medical cost. If you haven't yet read my post about questions to ask before choosing a medical plan please click over as the number one way to save money on medications is simply to understand your medical and prescription drug plan. 1. FSA and HSA PlansFlexible Spending Plans (FSA) and Health Savings Plans (HSA) are accounts you are able to put money into on a per paycheck basis for medical bills on a pre-tax basis. If you have these plans available to you a strongly suggest that you explore those plans and run the numbers in various scenarios as they can save you a lot of money each year. In the case of HSAs they can also let you invest for future health care costs in retirement as well plus both of these plans lower your taxable income which is a plus. 2. Try a Sample FirstWhen you are prescribed a new medication you are typically given a script for a month's supply. Sometimes that new medication simply doesn't work out due to negative side effects or incorrect dosage and the rest of the prescription is wasted as you can no longer take it and have to get a new prescription. This waste- or resources and money- can be stopped by asking for a sample from your doctor before filling th prescription. They can often give you a week or even a month of medication for free to try before you buy as it were. If it works for you- awesome, less money out of pocket for something you love. If not- at least you didn't spend money on something you won't use. 3. Check Your Insurance Program's AppThe insurance program's app is often under utilized. Heading to the app can give you an e-card if you don't have a physical card with you can be helpful but they often have price comparison guides, lists of covered medications, contact buttons, and more just a click away so that you can check before you even leave the doctor's office what your costs are going to come out to (estimated of course). 4. Switch to GenericsGeneric medications are not the exact same formulation as the name brand but they are very similar and depending on your other medications, treatment needs, allergies, and etc. you could very easily be taking a generic form of a medication and see no difference whatsoever- other than big savings. There are circumstances where people are not able to tolerate one generic form of a medication or must take a specific brand name medication and those circumstance would out weigh the financial situation but the chances are that you can, and should switch to generics whenever possible. Example (according to GoodRx): EpiPen 5. Ask About OTC OptionsIf you are on a pricey drug and have seen medications on the shelf at Wal-Mart that claim to treat the same ailment your prescription is treating you might need to switch to that over the counter (OTC) medication. Check with your doctor before making any medication switches as there may be other ingredients or drug interactions that are at play. I am currently on 3 OTC medications that the doctor has included in my daily treatment plan. This does mean that those costs -are not included in my deductible or out-of-pocket max though so I personally pay more per year due to this but I hit that max every year with my medical conditions... for the average consumer this will be more likely to help their budget than hurt it. Run the numbers to find out though and you may even be able to do this in reverse if there is a covered prescription drug rather than the OTC version. 6. Check Your Dosage OptionsJust because the medication is double the strength doesn't mean that it is double the cost. Ask your doctor if the medication you are taking two times a day is available in a scored tablet for twice the dosage. If it is you may be able to split the pills yourself each day and save money. Its important to ask if your medication can be split or not as extended release medications, caplets and some other medications cannot be split safely. 7. Price CompareYou may think that the price of your medication will be the same no matter where you pick it up due to your insurance card but that's not actually true sadly. Your insurance provider negotiates the prices of medications with these distributors so the cost varies by where you get your medications. There are apps out there whose sole purpose is to show you the cost of your medications at various pharmacies so that you can make an informed decision on where you fill your medication prescriptions. Combined with your insurance and any coupons you may have or be able to get through any of the options below you could save a lot of money and even get some medications for free! On this note... you should also ask how much it costs in cash, without insurance when getting medications. Sometimes it can be cheaper without insurance or you can use a coupon you couldn't with insurance to get a better deal. Be aware that going outside your insurance company means that it doesn't count towards the deductibles and out-of-pocket maxes so it may not actually be a better deal long term but depending on your situation it could save you money to go this route. 8. Mail Order/Bulk DeliveryOften times you can get a discount on the medications you take every month by having your doctor write you a script for 90 days rather than 30 days. You can have this 90 day prescription filled by an online pharmacy and shipped directly to your house saving you money on gas as well as the cheaper-per-dose prices for ordering in bulk. I typically use the one my insurance recommends but there are cheaper alternatives sometimes... just be very careful if you do this to verify the legitimacy and legality of having that particular pharmacy ship you your medications. 9. Coupons & Patient Assistant ProgramsBet you didn't know you could coupon medications. You totally can! Not every medication has a coupon or program available but a quick Google search of "Medication + Coupon" or "Medication + Patient Assistance" could net you big savings. I personally am enrolled in a program that pays most of my costs for a medication that costs over $2,000 per month up to $10,000 per year as well as using a coupon for my annual Epi-Pen (generic brand, of course). I have also had coupons for free inhalers and other medications. Many of these coupons and programs have requirements and stipulations (such as being under a certain income, having or not having a certain type of insurance or etc.) and an approval processes but taking the extra time to fill out the forms could save you hundreds or even thousands of dollars each year. The coupons might get you a discounted rate on the medication, a rebate for your medications if you mail in the receipt, or even free medication for a limited time. Most of these are from manufacturers so you do have to get the exact brand which isn't always the easiest to do but its worth it. My pharmacy is special ordering the generic Epi-Pen that I have a coupon for so that I can get the lowest possible price for my necessary medications, it will take a few extra days or maybe even a week but I'm willing to wait as those savings add up. 10. Prescription Savings CardsThis one is one that I will tell you to be careful with. While you can save money at point-of-sale for your medications potentially you may be going around your insurance plan to do so. Doing this means that it isn't being counted in your deductible and out-of-pocket amounts so, like moving to OTC medications, it may actually cost you more in the end if you are going to be getting up towards that out-of-pocket maximum amount by the end of the year so run the numbers and make sure you're making the best decision before you do this. Some cards don't go outside the insurance and work the same as a coupon though... just be careful and ask the Pharmacist to explain all your options and how it will interact with your insurance plan before choosing this option. 11. Pharmacy Discount PlansPharmacies are always trying to get customers in the door and need repeat business just like any other business so they often will have discount programs for their customers that they run... especially big-box stores like Kroger and Wal-Mart. Wal-Mart has a $4 prescription plan for instance for a 30 day supply of medications for a list 2 pages long. If you are taking one of these medications then it would be a good choice to consider them for filling it. They make money off the other medications you fill with them as a repeat customer so it makes sense for them and it makes sense for you as its cheaper. One thing to note here is that if you are getting medications at different pharmacies you should make sure that they all know all medications you are taking. If they don't they can't give you important information about drug interactions or valuable suggestions on alternative options. They may even be able to match price with the pharmacy you are getting your other medication from if you let them know that's why you aren't getting all of your medications from them. 12. State Subsidies and Other Care PlansDepending on your situation you may qualify for additional assistance from the federal or state government. If you think this could apply to you it is important you reach out to to their assistance agencies to find out if you qualify. These programs are often limited to those in lower income brackets, on other assistance programs, enrolled in Medicare or etc. but looking at all of your options is an important part of advocating for the best possible care you can get. 13. Talk to Your Doctor...If you have a question about why you are being given a specific medication or if there are alternative options then the best person to ask is your doctor. Being open with them and discussing the financial implications of your treatment plan is the first step towards being an informed, involved participant in your own care which is what we all should strive to become. If you let your doctor know that X medication is higher priced than you can afford and ask for alternatives they can help. Often they are not aware of medication costs as they are not involved in the negotiations your insurance company has annually with drug manufacturing companies, but once they are aware they can help you find an alternative treatment option that is a better fit financially but also works for your health management. 14. Ask Your Pharmacist...The last tip today is simple to ask the pharmacist: is this the cheapest option? They may know of a coupon or other discount that can save you money on the spot. Don't...

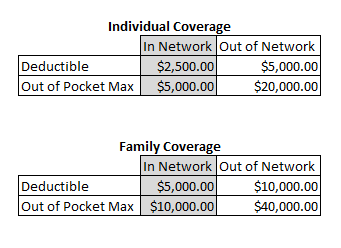

I've been wading through this costly medical system most of my life but hopefully you won't have to waste as much money as I'm positive I did over the years while still learning about these options with these tips. Until next time, Formulary, Preferred, Generic, Name Brand, Off Label, Pre-approval, Copay, HDHP, PPO, HMO... there are so many possibly unfamiliar terms when it comes to medical insurance. When you are signing up for a medical plan, whether through your employer or the market place, it is imperative that you make yourself an informed consumer. This means taking the time to understand all the ins and outs of the plans available to you and your family. If you are choosing insurance through your employer the Human Resources department can be an invaluable resource for you. They know the ins and outs of your plan(s) and if they don't have an answer to a specific question they can often give you the number of someone who will. It is important to remember that they are still your employer and coworkers so you may not want to share ALL your medical information with them but they can help to explain your plan options in broad strokes so that you can chose the best plan for your family. A few things to look for: What pharmacies and providers are in-network?Never ask a provider if they 'take' or 'accept' your insurance- the answer will likely be yes- you want to know if they are in-network. I'm not completely jaded and understand and even trust that most providers will be up front with me if I mess up and ask if they take my insurance but I was burned once, badly, and learned my lesson so no longer do this. In my case I was lied to by a front office staff member at an Urgent Care center and spent the better part of a year fighting about those out-of-network costs with the provider and my insurance company, it was not fun. If there is a provider that it is important that you see then you should call the insurance company and ask if they are in-network before you sign up for a plan and double check with your insurance company before going to a new provider. Going out of network can mean significantly higher costs not just for your specific medication or visit but for the whole year as you have separate in- and out-of-network deductibles and out-of-pocket maximums. It may look something like this: Are there Preferred pharmacies?This can often save you money as well. You will often see this affecting you when it comes to co-pays and co-insurance so it never hurts to ask. Going across the street could save you 10%! What is my deductible?Is there a per person deductible or per family? Does it include prescription medications or is that a separate deductible? Some plans will have a separate prescription deductible that you will have to meet before medications reduce in price or become paid for. This deductible will typically go towards to you out-of-pocket maximum just like your medical deductible but its important to know if you are going to be juggling multiple deductibles. What is my individual and family out-of-pocket maximum?If you have one high utilizing family member then its important to note that often plans will include a per-person cap that can keep your costs lower... you many not have to get all the way to the family out of pocket max to stop paying for that person's care for the year. This can be a lifesaver when it comes to the budget. What medication are formulary or covered?Check the plan every year, even if your plan has not changed, to make sure that all your current medications are covered. Insurance companies issue a new list of changes each year and you can often find this on the website but if not then simply call in and request it. How does the co-insurance work?Once you hit your deductible you will often still be responsible for some of the costs until you reach a higher number, the out-of-pocket maximum. This is usually calculated at a percentage. So if you have a co-insurance of 80% once you hit your deductible that would mean that you are responsible for paying 20% of the cost for your care until you reach that number. In and Out of Network still apply for this portion of your yearly cost so its important to stay in-network if at all possible. What are the requirements for Specialty medications?For certain medications, typically higher costing medications and ones that require temperature control, some plans will require you to use their Specialty Pharmacy in order to get them filled. This saves them money which in turn saves you money in the long run but it can be a little frustrating to have to schedule delivery for these medications and call in your payment/authorization to ship each month. If you have a medication that falls under this type of requirement they will let you know when you try to fill it at a retail pharmacy but if you think it may apply to your situation it could speed up the process to simply call the insurance company to ask up front what their policy is in regards to that medication. Processing at these pharmacies takes much longer than your corner CVS so planning your doses out is imperative for these kinds of medications. How do Prior Authorizations work on this plan?Certain medications, treatment plans, surgeries or even provider types may require Prior Authorization in order to be covered. These will typically span a length of time and then require renewal if it is an ongoing treatment. This is a pain to go through and number two cause for my personal medical plan headaches but its important to understand and follow this process or you could end up paying the full cost of treatment as the charges will be denied. I am personally on a medication that costs over $2,000 per month for me to take... you can bet it requires Prior Authorization. Every 6-18 months (depending on how long they authorize the treatment plan) my doctor's office has to file paperwork showing that I still need the care. Sometimes its easy but other times its a fight. Sometimes its just not worth that fight and we will chose an alternative treatment or I will pay out-of-pocket, like i did for my current rescue inhaler. Being prepared for this process and not letting it frustrate you if important- the insurance company is trying to keep their costs down by verifying that the treatment is necessary which helps keep costs from rising even more for everyone. What do I need to do in order to see a Specialist?For some types of plans all you have to do is show up to receive covered care but for other you may need a referral. Knowing this up front will save you headaches and money from fees for seeking care without a referral. Is ____ covered?If you are looking for a specific type of care then ask up front if it is available on plan and if so how many sessions/how often you are able to get it. A good example of this is chiropractic care. Some plans offer it but they may limit the number of sessions you are able to have covered per year. Other options could be infertility treatments or in-home care. If its not then you may need to purchase supplemental insurance or go with a different plan. Are there any perks to the program?I am with Blue Cross Blue Shield of Texas currently and there are a ton! My plan includes an identify theft program, a gym membership discount plan, teledoc services, free coupons to all kinds of health related retailers, discounted magazines, a wellness points plan and even discounts on services they don't cover like acupuncture and massage at certain providers through one of their free programs. On the wellness plan I get points for doing things like going to the gym, taking an online class, entering my stats quarterly, and etc. which I can exchange for prizes like kitchen gadgets, gift cards, and more. You can bet I participate in this when I have time... a few minutes while waiting around gets me a little closer to a free blender. :) Does this plan qualify for a FSA or HSA? If so is one offered?Flexible Spending Plans (FSA) and Health Savings Plans (HSA) are two ways that you can pay for medical costs with pre-tax money. They both have their own requirements as well as good/bad points but having access to pre-tax money can save you quite a bit of money. I'll do a separate post on these plans but if your employer offers them please learn about them and utilize them. They may also have a Limited FSA just for Dental and Vision, a Dependent Care FSA to help pay for childcare expenses pre-tax or an Health Reimbursement Program (HRA) that, while it isn't tax free, is free money to help you meet your medical costs if you submit for it. All of these plans are going to be employer specific in whether they are provided and through which providers but making sure to really understand your benefits package is an important part of providing health care for your family and being an advocate for your own.

I hope this helps you navigate your medical insurance journey. Until next time, It’s difficult to explain how important it is to lower my monthly expenses by paying off my student loans- as well as other debt- without explaining where a huge chunk of my annual income goes without any real choices… my medical expenses.

For someone like me who has chronic illnesses, maintaining health insurance coverage can literally be the difference between a fairly normal life and absolute destruction. I make the joke that I work for health insurance but to be honest it’s not much of a joke. According to BCBSTX the billed amount for my medical expenses in 2018, a really good year for me with only one chronic illness really causing problems rather than all three, was $46,823. That’s a full time salary for many in the US and it doesn’t even take into account costs that I incur outside of the insurance plan for uncovered medications and services. In order for me to ever be fully financially independent I need to eliminate as many of my monthly debt payments as possible while also building a large emergency savings so that in the event of a job loss I could afford to maintain my healthcare costs without going bankrupt. For this reason, I thought taking you through a summary of my anticipated costs for 2019 would be helpful. So here we go. First, some important terms then a summary of this year’s insurance plan and then a quick run through of additional costs. This post is part of a series that will look at ways to save money on medication, questions to ask your HR representative during Open Enrollment season so that you can make an informed decision and more. Insurance and healthcare are, understandably, a huge passion of mine which I have only dug deeper into since beginning to work in Human Resources four years ago. I hope that this series can be beneficial to you. Important Terms

My Insurance Plan I currently have a fairly good plan but it is a High Deductible Health Plan which can get very costly if not budgeted for and fully understood. Being an informed consumer is of utmost importance with this kind of plan as 100% of the cost for services is on you from day 1 until you meet the deductible. Here are the details for my exact plan:

My insurance plan does not cover two of my currently prescribed medications (up from one in 2017) or any of the over-the-counter medications that my doctor utilizes as part of my treatment plan. This part is standard though, no prescription drug plan will cover OTC medications as a rule and have exclusions for covered prescription medications. Since this particular medication is purchased at a compounding pharmacy is was pretty much known up front to be an uncovered expense. It also doesn’t cover some of the testing I have to do at my allergist/immunologist’s office when I am in a flare, vitamins and minerals that I supplement with when symptomatic, or any of the alternative treatments that I have found helpful to maintaining my health. While it is true that most of these costs boil down to personal choices that I have made to seek these treatments the quality of my life has increased drastically since introducing them so keeping them in my treatment plan if possible is ideal. Not Covered Costs Breakdown

Without any of the ‘not covered treatments’ category we’re looking at:

Other Costs One thing that isn’t accounted for in any of these numbers is the fact that I have to be careful about the foods that I eat and products that I use. I am allergic to a lot of things- most artificial scents, gluten, celery (random I know), bananas, and a slew of other things. This translates to needing to use more expensive personal hygiene and cleaning products in many cases as well as having a more heavily padded food budget than your average single person. I wish I could discount this but its part of my life and relates directly to my health issues so it likely should be mentioned. In my house you will find no scented candles, plug-ins, or etc. as they trigger migraines for instance and just this past Christmas I borrowed some basic laundry detergent while on vacation and was covered in hives for three days… so you can imagine a lot of shampoos, detergents and etc. can ruin my week pretty easily. Ways I Lower My Costs

I write all this out not to convince you to feel sorry for me or what have you, because I think that I am extremely lucky to be able to work at all as I have many friends who are not able to do so. And not only that but I have a job I love, that pays me enough to afford the life I have- including insurance and salary that can encompass these expenses, a life that’s amazing with hobbies that bring me joy and friends that bring light and happiness to it, and a family that is just without words wonderful. It’s more than I deserve and I will always be grateful for it all. I write this to show you a window into my life for better understanding of one of my largest “why’s” when it comes to becoming financially independent and debt free. Having a “why” for your goals is important as without one you will be more likely to convince yourself out of the hard but necessary tasks along the way towards reaching your goal. Until next time, |

Details

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed