|

Now more than ever, a home is more than just a home. For those starting a new business, home may be where your company is located. New business owners need a space that encapsulates all the necessary components: an office, storage, and ample living area. After work, entrepreneurs then need their home to be an ideal space to unwind and spend time with family and friends. Business owners who are just starting can find a home that accommodates a space for living and working. One important consideration for new business owners is finding a place that will work in the long term as your business expands, as well as meeting the needs of your personal life. Real Life with Heather presents some tips you need to consider. Pixabay.com Determine Your Ideal-Home CriteriaWhen shopping for a home as a new business owner, create a checklist of your most important criteria. Staying focused on your needs is crucial as you shop for a house, and it can prevent you from getting swept away by the cosmetic details of a home that may not otherwise be practical. Jot down ideas you like, and even create a dream board of design elements to later incorporate into a home that suits your needs for living and working. Consider the number of bedrooms you need, keeping in mind any plans for having children and providing ample room to play and work. It may also be wise to consider a guest room for family and friends who visit. Business owners should also prioritize a home office. Depending on the type of business you operate, you may need storage space for your supplies and a manufacturing area. If your business primarily takes place online, then you’ll need an internet connection that’s both speedy and reliable. In fact, internet speeds and availability may help determine where you’ll move. Custom-Built Homes and ModularsIf you are having a difficult time finding a home that works for you, it may be time to think about having one custom-built. Weight the pros and cons of buying versus building a home. Some of the important considerations are timeframes, building costs, and land-prep fees. Home construction can be costly, but repairs and renovation fees to an existing structure can be pricey as well. It may be wise to consult a contractor and obtain estimates prior to deciding. Modular homes are also popular choices among new homeowners in today’s market, and they can be completed much faster than a stick-built house. Shop around with varying modular dealers to identify setup fees and other costs. Whether you opt to build or go with a modular, there are many quality builders available. Once you have found your ideal home, the moving process begins. Many people dread moving, but there are ways to reduce the stress and create a plan that gets you into your new home without issue. Create a Moving StrategyOne of the best steps you can take as you plan to move is to reach out to moving companies and hire professionals to assist you. Movers can be easily found online in your area in just a few keystrokes. Be sure to check out the ratings and rates of several movers prior to making any commitments.

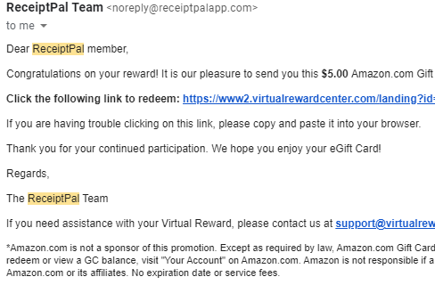

As you pack your belongings, stick to an organizational strategy that will make your unpacking process simple. If you take your time and stay organized, your moving process will be much smoother in the long run. Soon you will be settled into your new home-based business and living the life you have always envisioned. You can find your ideal home that meets the needs of your new business and personal life. In today's edition of money making apps we're looking at ReceiptPal, yet another receipt submission app... as I've said before, I stack them in order to get the most reward back for each receipt so I have quite a few on my phone at the moment. In this app you upload receipts 4 to a card with each card being worth 100 points. If you fill all of the available cards in a given week you can enter extra receipts into the last card for sweepstakes entries or wait for the cards to refresh, so long as the receipts do not age past two weeks they can be entered on any cards available. Recently the app has added Amazon, Kroger and a few other retailers to be able to connect and auto-upload receipts from online purchases in addition to the email connection option for e-receipts. This means that your online purchases get you points here whereas in some apps they still do not. The website for ReceiptPal describes the app as follows: ReceiptPal lets you earn gift cards and cash prizes, for submitting receipts. Use ReceiptPal to snap your paper receipts, or connect your email or Amazon account, and you’ll earn points for every receipt. You can redeem your points for gift cards from retailers. Plus, you’ll be automatically entered into weekly sweepstakes for cash prizes. Redeeming points earns you Amazon gift cards in $5, $10, $25, $50 or $100 increments with a discount for larger gift cards. If you prefer entering a sweepstakes with your points you are also able to choose this option. Once you choose your reward an emailed gift card code is send to you to redeem on Amazon. There isn't a referral link for this one but it was super easy for me to find on the app store and get started. Until next time,

Keeping my costs down when it comes to groceries is important to me. But so is my time, and I certainly don't have a ton of that to spare these days- like most of you I imagine. 1. Keep an InventoryKeeping a pantry and freezer inventory (link to video of how I do this) is an essential step so that you don't purchase items that you already own. I mean, who hasn't wondered if they have mustard at home and bought another one just in case only to return home and realize you have two already... just me? Ok then. It also helps with meal planning! For example, say that you take a look at your pantry inventory and realize that you have 6 ingredients that need to be used up in the next couple weeks before they expire. You can make sure to build your meal plan using those ingredients, as well as other ingredients that you already have, which means that you avoid food waste as well as lower your overall grocery bill because you may only need to purchase a handful of items for the week rather than a whole basket full. I personally use this system and even brought my mom around to using it last year. We love it so much that I recently created new trackers for us in some of our favorite colors and fonts so that we could match our kitchens rather than continuing to use the ones we have been using for the past year or so. If you are interested in taking a look at those they are available in single item "Extras" for a couple dollars each at my Buy Me a Coffee page and in a bundle on Etsy. The set that I ended up printing for myself was the green in script font. 2. Shop the SalesAnother great way to save money on groceries is to shop the sales. I'm sure everyone has heard this before but it is worth repeating, if you buy the same items again and again look for a good deal to come around and stock up. Using your inventory will help here because you'll know what your preferred amount to have on hand is compared to what you have at home. If an amazing sale on taco seasoning comes around you better believe I'm buying a bit extra but that will only save me a few dollars a month... the big savings comes with your meats. If you have a freezer put it to good use and fill it with sale finds (working it into the budget, of course) when they come around. And then build your meal plan around what you have rather than the other way around like most of us do. One quick last note on this one: many people use methods to help stock up their pantries using this method. Buy 1 for now and 3 for later for instance... or 'when its on sale 20% less than normal I will buy double'. Find what works for your needs and goals. 3. Use Cash Back AppsI've said this a million and one times I'm sure but I love a good cash back app. If I'm already spending money and I can get a small percentage back for 10 minutes of time a week while I'm watching TV you better believe I'm there. I have an entire set of folders on my phone dedicated to trying out apps for you guys to see if they are worth it or now. A couple months ago I made over $60 back in a single month! Not every month is that profitable of course but over the course of a year I can easily pay for a couple of my trips to the grocery store with the cash back and gift cards I receive from simple uploading receipts and clicking a few buttons. 4. Meal PlanI've mentioned meal planning a few times so I'm sure that you saw it coming, but... meal plan y'all. Meal planning, and following your plan, saves you money both on the front end like I mentioned before- less purchasing- but also during the implementation time, during the week when things get crazy. Have your schedule with you when you sit down to decide what you are making this week. If you aren't going to have time to cook on Tuesday then perhaps it would be a good day to use leftovers or a pre-prepared meal that you have in your freezer. If you know that Thursdays are the day you typically cave to eating out then plan to have one of your favorites on Thursday so that you are more likely to get home and have that meal rather than eat out. Having a couple of pre-prepared favorites in the freezer for days that just don't go as planned is a great idea. Some people like to have frozen pizzas, homemade taco filling (my fav personally) or burgers. Fast, simple and delicious- having favs already made makes it easier to skip not so great for you- or your budget- fast food delivery. 5. Plan for LeftoversLast but least, for today, is leftovers. The often dreaded and maligned food that didn't get eaten the day before. Not all of us love leftovers but most of us have them from time to time sitting in the fridge. I'm going to suggest having them on purpose though and even repurposing them into other meals. For example, if you are having fajitas on Monday then make extra to have quesadillas on Tuesday or Wednesday. If you make grilled chicken salads on Thursday then use that extra from your double batch to turn into buffalo chicken stuffed peppers on Friday night. And I haven't even talked about lunches- so many things that we have for dinner can be eaten the next day as lunch with minimal extra effort but with a totally different taste profile. That chicken from before could also have been Greek kabobs on the grill at night and then turned into a chicken Caesar wrap for lunch the next day. Save the food waste- and save a ton of time as well- by planning for leftovers.

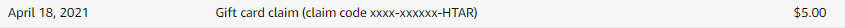

I hope that I was able to give you a few ideas that you may not have thought of before. If you have more ideas, let me know in the comments. I'd love to hear them! Until next time, In today's edition of money making apps we're looking at Receipt Pal, another receipt submission app. This app makes it easy to submit receipts, simply click the camera icon, snap a photo of the receipt and you're good to go. You will need to show who the purchase was for- one person, a group, or etc. and give the interaction between 1 and 5 stars. Occasionally this will be substituted with a survey question. You earn sweepstakes tickets for each week you upload at least once as well as for certain types of receipts. You also earn an entry for each receipt that you upload and can earn slots pulls for additional tickets as well. Outside of sweepstakes entries you also earn coins for each receipt. The number of coins is dependent upon the amount of your purchase from the receipt. Under $10: 5 coins Between $10 and $50: 10 coins Between $50 and $100: 15 coins Over $100: 20 coins You can redeem for Amazon gift cards as well as cash out with PayPal or a Visa gift card. In April I chose to get an Amazon gift card to go towards a larger purchase I was making. The process was simple to redeem. If you use a referral link then you receive bonus points upon sign up, helping you get to your first gift card all that much faster. If you are interested in using my code it is: SMUR5412 Untl next time,

Photo Credit: Rawpixel Think estate planning is only for seniors? Well, estate planning can be just as smart for you as it is for your parents and grandparents. That’s because the point of creating an estate plan is to protect your loved ones from the undue stress of having to make decisions and foot financial obligations when they are also dealing with their feelings of grief over losing you. Wondering where to start? Real Life with Heather shares some crucial estate planning steps every adult needs to take. Buying Burial InsuranceIf you want to save your parents or other loved ones from having to cover your end-of-life costs, you should consider buying burial insurance. Burial insurance tends to be fairly budget-friendly and provides benefits that can offset funeral expenses and help out with debts, including personal loans and hospital bills. You should determine what all your final arrangements will entail and how much you need to protect your family. Purchasing Life InsuranceBurial insurance provides basic financial protection and can benefit just about anyone. If you have larger debts or a family who depends on you for income or care, CNBC suggests you really should be researching life insurance as well. The larger payouts that come with standard life insurance can help with mortgages and other major expenses, plus your policy will likely be cheaper. Planning Their Own Funerals If you want to ensure that your life insurance or burial insurance funds will cover funeral costs for your loved ones, then you also need to plan your own funeral, notes The Motley Fool. This may seem like a stressful task but using an online guide can help keep you focused and objective. Once your plans are laid out, you should share them with a trusted friend or loved one, to ensure they are honored. Appointing Legal GuardiansParents need to think even more seriously about estate planning. One of the most crucial steps parents can take to protect their children is to appoint legal guardians/conservators. This will ensure that kids do not end up with family members they do not know or even in the foster system. Have furry kids in your family? You should appoint caregivers for your pets as well so that you will know they are taken care of even if the unthinkable should happen to you. Planning for Long-Term CareHaving a plan for long-term care can be crucial for your well-being, whether you’re in assisted living or a nursing facility. Many younger people choose to purchase long-term care insurance to help offset the costs. It’s never too early to research facilities and their costs to get an idea about potential expenses. Senior Care offers pricing information on several Dallas-based skilled nursing facilities. Drafting a Last Will and TestamentWhen you need to appoint guardians or caretakers for your pets and children, AARP points out that you typically include those details in your last will and testament. This is a legal document that ensures your last wishes are carried out after your death, and your will should also include other provisions regarding your estate. For example, if you have any personal property or assets, you can use your will to divide them among your friends, family members, or even charities. Completing Advance Directives Because your friends and family members can also be faced with making decisions about your medical care during an emergency, you should also include advanced medical directives in your estate and end-of-life planning. Decisions to be made include whether you would like to be resuscitated, donate organs or stay connected to life support systems. These directives require a physician before they can be honored, but you will also need to assign a power of attorney. And as with many of these steps, it’s important to discuss these matters with a lawyer. Organizing Financial PapersLast but not least, if you have any documents regarding bank accounts, personal info, life insurance policies or passwords for essential accounts, you should make sure these papers are kept organized and in a safe location. Also, make sure that a close family member or friend will have access to these documents in the event of your passing so that they can take care of any crucial business. Taking this important planning step can save your loved ones a lot of stress. Estate planning may seem like a waste of time when you feel like you have your whole life ahead of you. The truth is that you can never predict when the unthinkable will impact you and your family. So, protect them by checking estate planning off of your to-do list. Setting goals and working to accomplish them is a very personal experience as no two people will have the same picture of the ideal life in their mind. Real Life with Heather inspires people to take charge of their lives and make them as amazing as they can be. Check out more informative blog posts today!

|

Details

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed