|

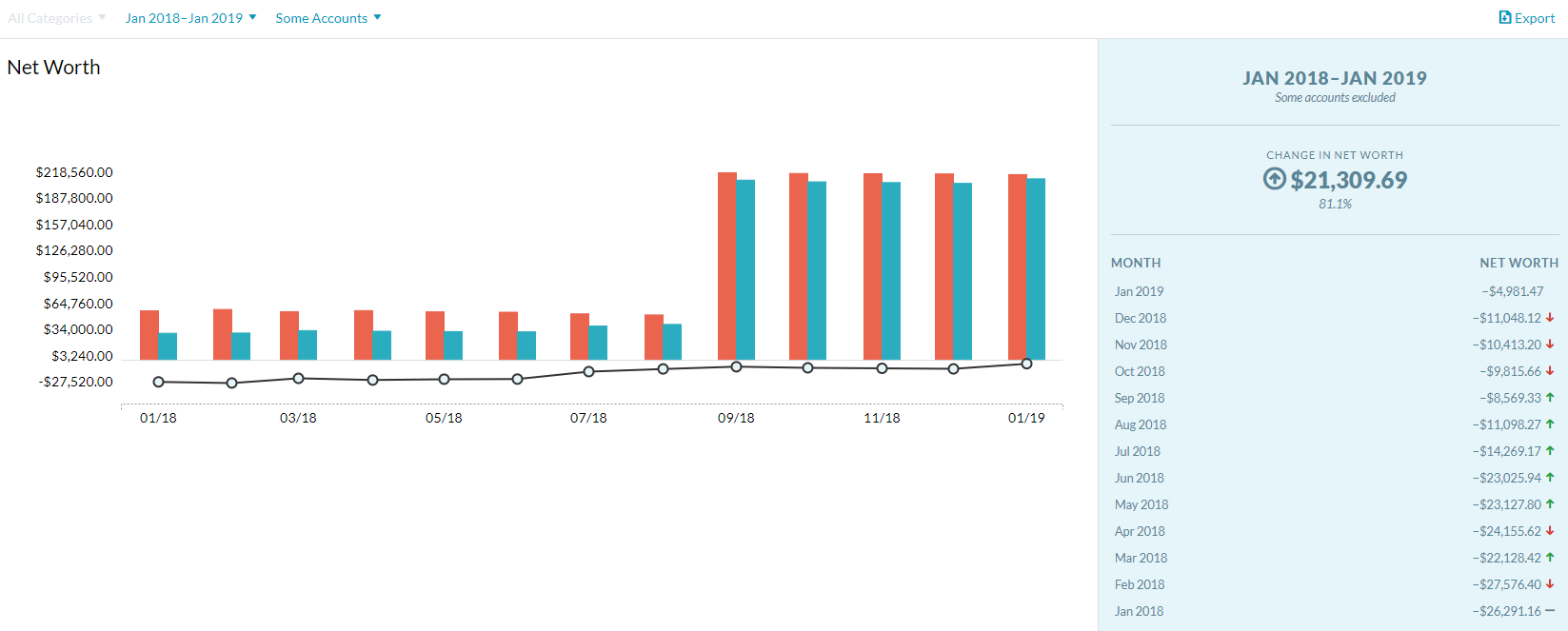

This month has been full of ups and downs when it comes to my finances- mostly ups though! I'm going to show you the graph early in today's blog post so that you can see what I mean. I'll be moving the graph over to 2019 only next month so that it is easier to see but for now you can see all of 2018 plus January 2019. The reason some of the decrease in November and December is also the reason for a portion of the sizable bump up this month- the market. The amount that my house is estimated to be worth went up this month and even though I don't have a lot invested right now- less than $10,000 divided between a 403b from my time as a teacher and a 401k from my current job- those accounts also increased this month, by more than just contributions. My job also started matching 4% in my 401k this month which did add slightly to the increase as well. The rest was good old fashioned payoff of debt. I'm positive I can hit my goal of being net worth positive this year so I'm feeling pretty happy right now.

I didn't bring in a lot of extra money from side hustles this last month ($56.18) but I was able to pay for several items with gift cards received over the holidays and from various apps that I have been trialing for the blog. Gift cards used this month included one gift of $50 and another $75 earned through travel programs and apps. It sounds fairly small but for me that's a week of groceries- or more if I'm eating mostly from the deep freezer's stash of meal prepped food with fresh veggies added in! I was also able to use a travel voucher I received due to a delayed flight last year to lower the cost of of my flight to DC later this year which was already budgeted for. This means that voucher allowed me to move $100 back into the general budget for allocating towards debt payments. These small savings really do add up. The final piece of the puzzle, as it were, was medical benefits restarting for the year. My company puts $700 into my HSA for me at the beginning of each year (and then I contribute another $2,800 to reach the max for a single person on a 1/25th per paycheck schedule for the rest of the year) plus they fund my Limited FSA of $500 upfront so I tend to get a bump in January each year on the graph due to this inflow. A lot of this money, if not all of it, will disappear over the next few months as my medical bills start rolling in. I anticipate hitting my out of pocket max of $5,400 for medical this year on top of the expenses that I know are not going to be covered- some of my chiropractor bills, my mast cell stabilizer medication, my inhaler, all of the over the counter medications that my allergist has in my therapy plan, and etc. and then the Limited FSA will cover most of the cost of my glasses and contacts which need to be purchased early this year. My medical costs are likely higher than many people's due to my medical issues (and my plan is fairly good, thankfully) so later in the year I'll likely create a blog about how I budget for and save money on my health care costs in a separate post. For now I just wanted to touch on these accounts as they do affect my net worth as the money in these accounts, especially the HSA, could potentially be money that is growing if I was able to not utilize it. What do I think February will look like... budget wise we were looking pretty good until a few weeks ago. Unfortunately it looks like the people who flipped my house cut corners (surprise surprise) so I will need to complete a repairs and projects on my home in February that may end up putting me in a little more debt. Not the direction I wanted to be going but you'll see why its important they not wait when you see the list:

Until next time, |

Details

Archives

October 2022

Categories

All

|

RSS Feed

RSS Feed